Choppies share sale profits linked to offshore activity

In 2013, one of Botswana’s wealthiest businessmen, Farouk Ismail, sold part of his stake in Choppies, a major retail chain store in Botswana, to Standard Chartered Bank Mauritius in an off-market transaction that earned him over $60 million.

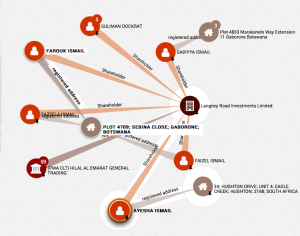

Documents from Panama-based law firm Mossack Fonseca, obtained by German newspaper, Suddeutsche Zeitung and shared by the International Consortium of Investigative Journalists, show that in October 2014, Ismail and five members of his family used agents in London and Dubai to invest in Langney Road Investment Limited using an elaborate system, suggesting concealment, in the tax haven of the Bahamas.

The documents do not establish that the Choppies founder and director used the network of companies set up by Mossack Fonseca to evade taxes. The commercial purpose these companies has yet to be explained.

Choppies is listed on the Botswana Stock Exchange and the Johannesburg Stock Exchange, and Ismail is the second biggest shareholder, with a shareholding of 14.6%, valued at over $100 million.

Certificate of Incumbency

The leaked Mossack Fonseca documents show that Ismail’s son, Faizel, wife Fazeela, and daughters, Sadiyya and Ayesha, joined Langney, an “international business company,” four months after it was established by a Dubai-based front, Suliman Dockrat, in October 2013.

A certificate of incumbency shows that Langney’s “authorised capital” stood at $50,000 in October 2013, which, according to the incumbency certificate is “divided into 50,000 shares with a par value of $1 each.” Ismail and Faizel hold a majority share of two shares each, while the other four family members have one. Dockrat, who initially registered the company, subsequently resigned on 10 February 2014, the same day the Ismails took over the company.

Ismail’s investment in the company coincided with his decision to sell 12.7% of his Choppies shares to Standard Chartered Bank of Mauritius. He then opened an account with Standard Chartered Bank of London and transferred an undisclosed amount to the British bank.

“When you sell shares, it is not taxable,” Ismail said when asked about the sale. He invested in five “small” properties in London and said he had not declared any dividends. “If I declare dividends, I will pay Botswana Unified Revenue Services. I am still growing the portfolio.”

It is not clear why the family opened an account in the UK and bought a shelf company registered in the Bahamas that subsequently invested in shares in the UK.

Ismail also declined to disclose the amount invested in Langney, saying disclosure could cause his family to be targeted by criminals.

At a time when the Standard Chartered Bank transaction was being processed, Ismail and his son were also investing in a Chicken Licken franchise in Botswana. Newspaper reports at the time indicated that Faizel purchased nine Chicken Licken stores in Botswana. Documents obtained from Registrar of Companies identify Faizel as the sole shareholder of Setso Home, the company that owns Ismail’s franchise.

For the Choppies businessman, the trail of offshore companies and agents linked to him does, at face value, suggest a striving for secrecy. This secrecy puts Ismail’s financial affairs beyond the grasp of Botswana’s tax authorities.

While investing in a company in a tax haven may have an innocent explanation, none has so far been provided by Ismail. Asked to comment on the perception that his complex financial arrangements via Mossack Fonseca suggest that he had transactions to hide, Ismail replied: “I have no dealings whatsoever in the Bahamas. My account is in the UK at Standard Chartered Bank. I am liable for global taxation.”